The Irish internet is officially 30 years old this year (.ie domains were first launched in 1988) and so it is timely to reflect on the e-commerce landscape here in 2018. What are the big trends, who is doing well and what are the opportunities for Irish business over the coming years?

Most Irish adults are now purchasing products and services online with total e-commerce spend in excess of €6bn annually. That figure is expected to more than double in the next four years to €14bn. A recent analysis of the 500 most frequently used websites in Ireland paints a picture of how the e-commerce landscape has evolved and provides strong indications of which sectors and business models will fuel the future growth.

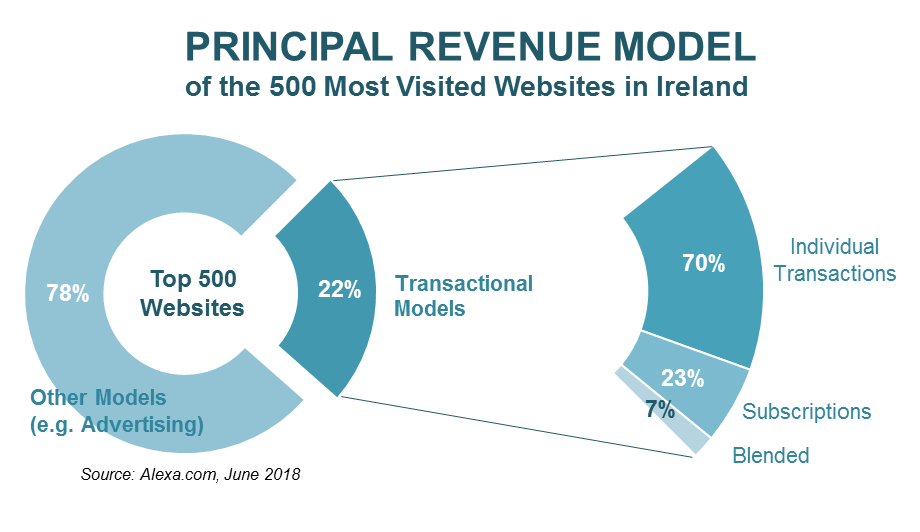

Just 22% of the top 500 sites in Ireland have B2C e-commerce transactions as their principal revenue model. The majority of the websites visited most frequently in Ireland (78%) are funded through advertising. This relative prominence of e-commerce sites varies from the UK where large e-commerce sites such as Amazon and eBay are more dominant than in Ireland.

The prevailing transactional model for e-commerce platforms in Ireland is Individual Transactions; 70% of e-commerce sites primarily sell their products, provide services or facilitate payments on an single transaction basis. These transactions include the purchase of products on the large international marketplaces such as Amazon, Ebay and AliExpress; travel bookings with Booking.com, Ryanair and Airbnb; and shopping online with retailers such as Argos, Ikea and Tesco. The presence of all the major Irish banking sites together with Paypal in the Top 10 e-commerce sites reflects the significant volume of payments now taking place online for e-commerce and other transactions.

Whilst the individual transactions approach still dominates, 23% of the most frequented consumer sales sites generate revenue primarily through Subscriptions. Some of the most dominant players with this business model, such as Netflix, Spotify or Soundcloud, barely existed 8 years ago. Subscription business models are a telling feature of many advanced internet businesses and require scale in order to achieve meaningful conversion levels from the typically freemium “try before you buy” sales technique. It is therefore not surprising that very few Irish platforms have achieved success here. The IrishTimes.com site is one clear Irish exception having introduced a metered paywall to maximise the return from their international reach in news. Opportunities for more niche Ireland-focused companies do exist as evidenced by the entry of the Junior and Leaving Cert exam website Studyclix.ie into the top 10 of subscription sites used in May/June 2018.

A small number of sites operate under a Blended business model, combining individual transactions with subscription revenues. The telecoms operators; eir, Three and Vodafone, dominate the category. Other international players with a presence in this market include Udemy which sells online courses to consumers and organisations on both an individual transaction or subscription basis.

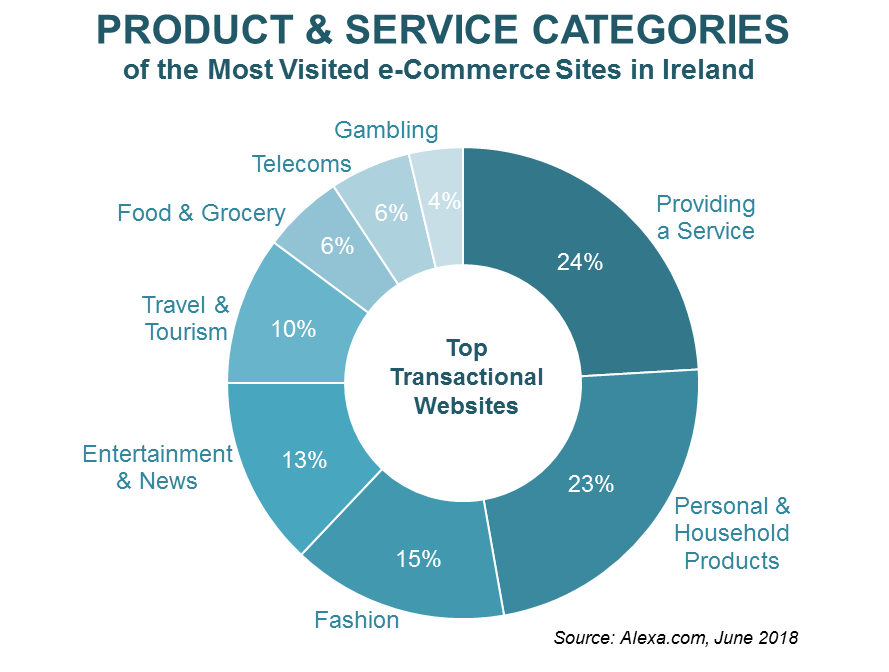

When it comes to the types of products sold by the top e-commerce sites, nearly half (47%) can be categorised as either providing a service or selling products for personal and household use. Providing a Service (24% of top sites) includes a wide range of offerings such as reimbursements via the banking and payments sector; premium subscription services for professionals such as those from LinkedIn and Vision-net.ie; and file transfer services from Dropbox and WeTransfer. The popularity of crowd-funding platforms such as GoFundMe.com and KickStarter.com demonstrate how much the social and start-up funding sectors have changed in recent years. Government services such as ROS.ie and Motortax.ie also feature highly in this category.

The sale of Personal and Household Products (23% of top sites) such as electronics, toys, games, books and furnishings is dominated by the global marketplaces of Amazon, Ebay, Aliexpress, Etsy and Alibaba. It is difficult for Irish companies to compete with the scale and reach of these platforms; unless they actively participate by becoming merchants themselves within these marketplaces. In terms of retailers with a footprint in Ireland, only Argos, Ikea and Woodies make it into the top 10 in this category.

The Fashion category stands out on it’s own accounting for 15% of the most popular e-commerce websites. Asos, SportsDirect and LittlewoodsIreland top the rankings, with Life Style Sports the only indigenous Irish company to make it into the top 10.

In the Entertainment & News (13% of top sites) category, reach, but perhaps not revenue, is topped by Netflix, IrishTimes.com and Spotify. Roblox.com is a notable player – an innovative gaming platform that acts like a marketplace for game developers and sharing revenue with them.

The smaller categories include Travel & Tourism (10%) topped by Booking.com, Ryanair.com, and Airbnb; Telecoms (6%) led by Eir.ie, Three.ie and Sky.com; Food & Grocery (6%) featuring Just-eat.ie, Tesco.ie and Dominos.ie at the top; and Gambling (4%) dominated by Lottery.ie, Bet365.com and Paddypower.com.

The sector that surely presents most opportunity to develop over the coming years, is Food & Grocery. The only two grocery offerings that exist in the Irish market both rank highly with consumers. The lack of choice here presents significant opportunity for market disruption by new players and by the other incumbents who have not yet developed an e-commerce offering.

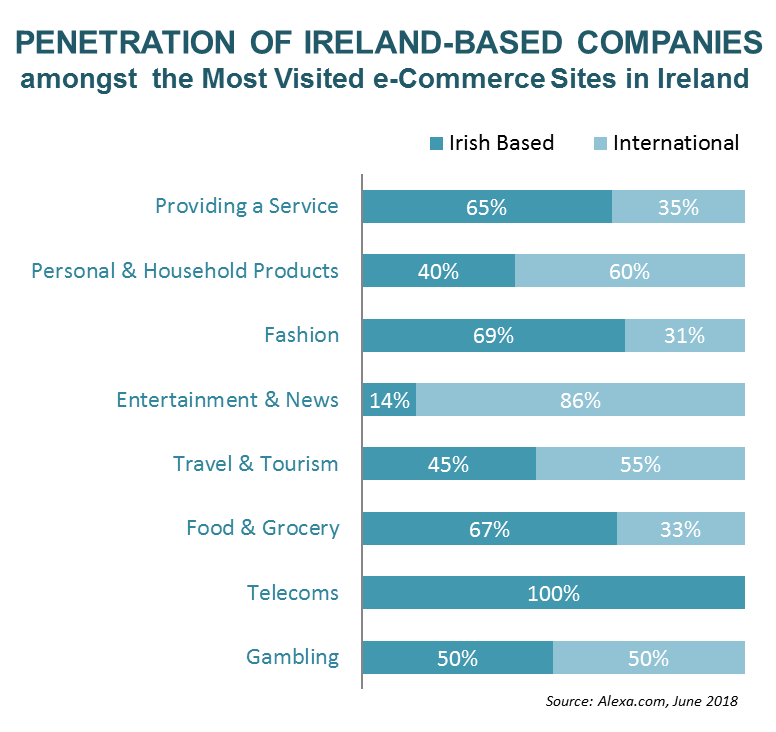

As a small and open economy it is no surprise that many of the Internet commerce players in the market are international enterprises. Around 60% of Irish online spend went to foreign retailers in 2018. This spend is not equally balanced across all sectors.

The telecoms sector is predictably dominated by Irish-based companies given the necessity for physical infrastructure. The online entertainment and news category is rather underdeveloped here with just 14% of top sites having an Ireland base. The category is dominated by large international entertainment businesses such as Netflix, Spotify and Apple.

Our indigenous fashion sector looks to perform well, accounting for 69% of sites, however the data belies the fact that many of the big players in this market (such as Sportsdirect.com, Littlewoodsireland.ie, Debenhams.ie, Riverisland.ie, Hm.com, Jdsports.ie) may have outlets here but are not indigenous to these shores.

Perhaps most surprising is that for the purchase of personal and household products (electronics, books, games, toys, furnishings) 60% of the top online players don’t have a physical location here. This is in spite of very well developed bricks and mortar retail businesses in these sectors. Have the Irish retailers been laggards at developing competitive digital offerings? While it can be difficult to compete on price with international players, when it comes to speed of delivery, local market knowledge and comprehensive service, surely the Irish players have the advantage.

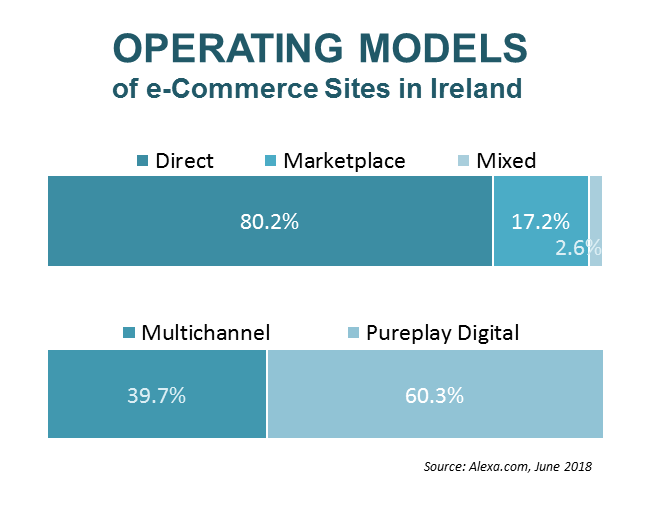

80% of the top e-commerce players sell direct with 17% operating as marketplaces and a small 3% adopting a mixed model. In the Direct model the retailer sources and distributes its own products, thus maintaining maximum control of the supply chain. Marketplaces have emerged as disrupters in so many different categories including Personal & Household (eBay, AliExpress, Etsy, Alibaba), Travel & Tourism (Booking.com, Airbnb, Expedia, Trivago, Hostelworld), and Entertainment (Patreon, Eventbrite, Bandcamp). Amazon remains the leader with a truly mixed model, selling its own products whilst also facilitating one of the globe’s largest merchant marketplaces.

Multichannel players in this market are exclusively the Ireland-based players in this analysis, whilst the majority of the Pureplay Digital, with no physical retail presence, are international companies. However, in the midst of those pureplay digital operators are a selection of innovative Irish businesses changing how we think about the opportunities for e-commerce in this market. Some examples include;

- Studyclix.ie is a clever business founded by teachers from Sligo, making it easy for students to access Leaving Cert and Junior Cert exam paper questions and marking schemes from €35 per year.

- Solocheck.ie and Vision-net.ie have made viable businesses out of company credit history checks, something that would have been costly and time consuming in the past.

- Parcelmotel.com by Nightline is a true disruption to the home delivery space, making it possible and cost effective for Irish people to have parcels delivered from overseas.

Successful innovation often comes from devising new ways to solve old problems. Pureplay digital enterprises are often in a better position to innovate given the lack of constraints from legacy business models. Incumbent retailers on the other hand have the advantage of knowing their customers better than anyone else and generally have the trust of those customers which is crucially important in bringing new offerings to market

The opportunities to further innovate and develop our e-commerce economy are manifold. Whilst 82% of people use the Internet to research products and services before they buy, only 22% of Irish enterprises are yet achieving e-commerce sales and 25% are achieving any kind of order via their online channels. This presents a clear mandate to Irish businesses to seize the opportunity and perhaps stem the flow of digital spend heading to foreign shores.

See the list of top e-commerce sites in Ireland across all sectors and categories here.